Dovish Fed

Fed celebrates victory vs inflation (prematurely?) by cutting rates aggressively

Good Morning,

After Fed Chair Powell and the FOMC committee decided to cut rates by half a percentage point Wall Street rejoiced as futures gained steadily overnight.

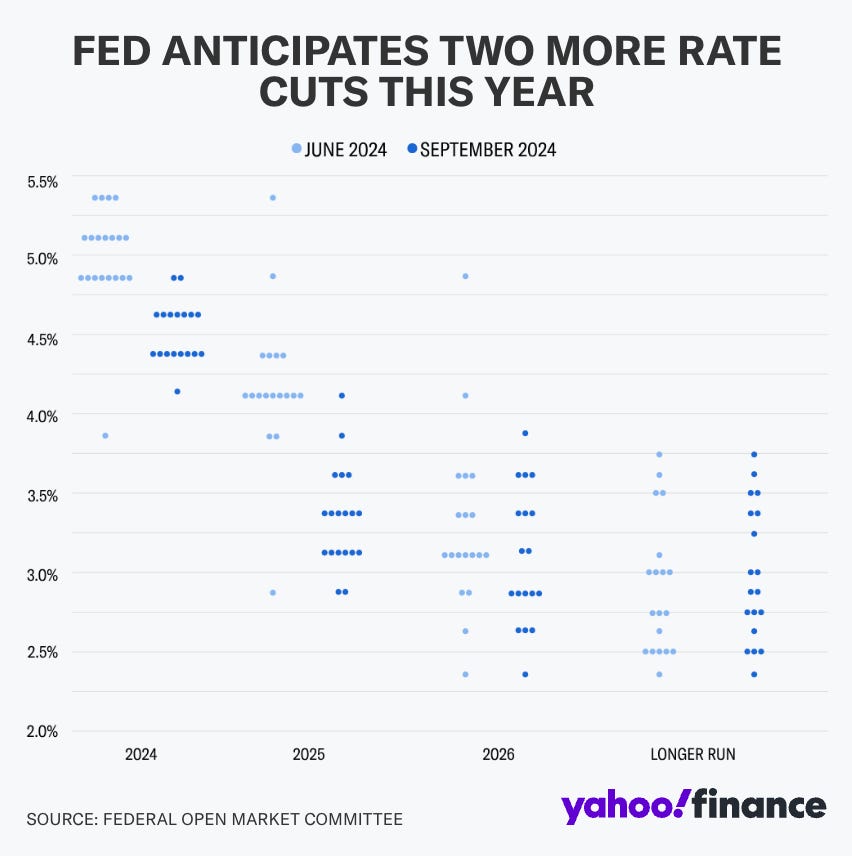

The Fed’s newest rate outlook shows that much of the committee has flipped its views since the last FOMC meeting. As a whole, the committee plans to be much more aggressive with rate cuts moving forward.

The latest projection shows that most FOMC members believe the Fed funds rate will return below 3% by Q1 2026.

With the new aggression seen in rate cuts, the question of a potential spike in inflation must be raised.

For now, Wall Street is celebrating so let’s see what could be in store for the coming sessions to close the week.

SPY 0.00%↑

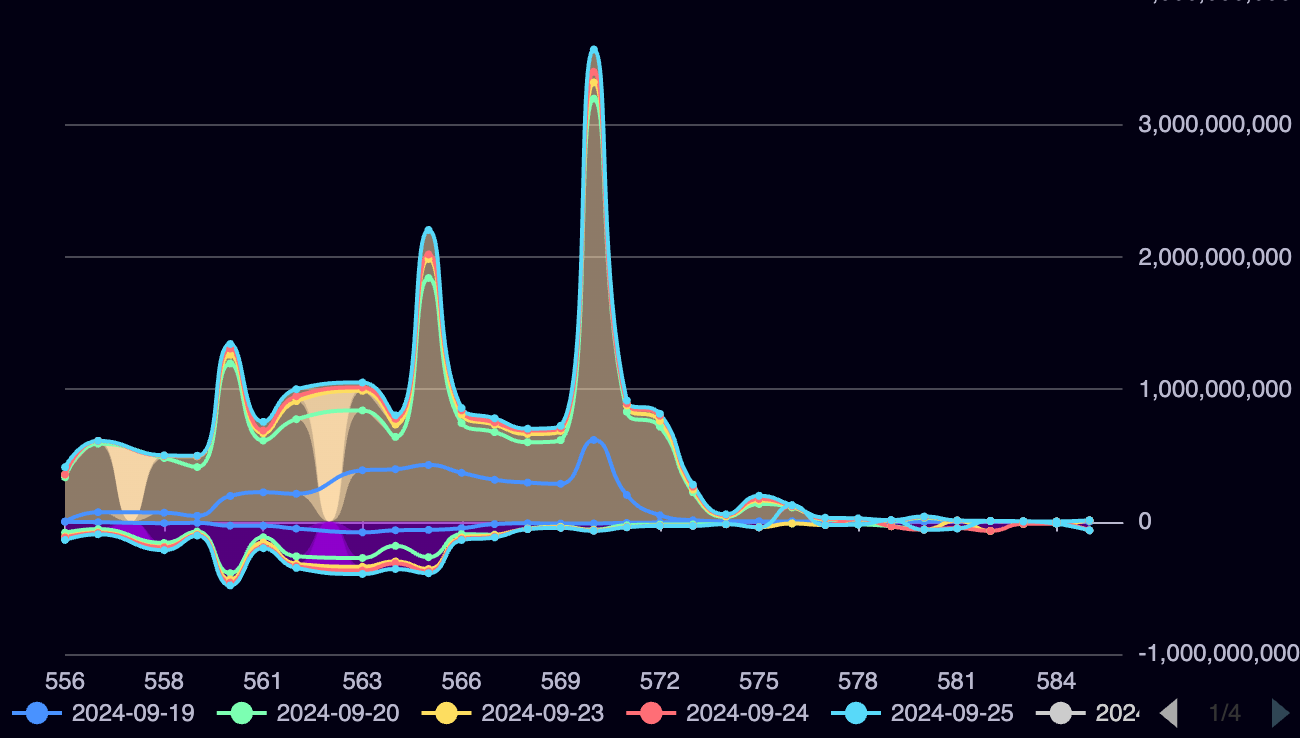

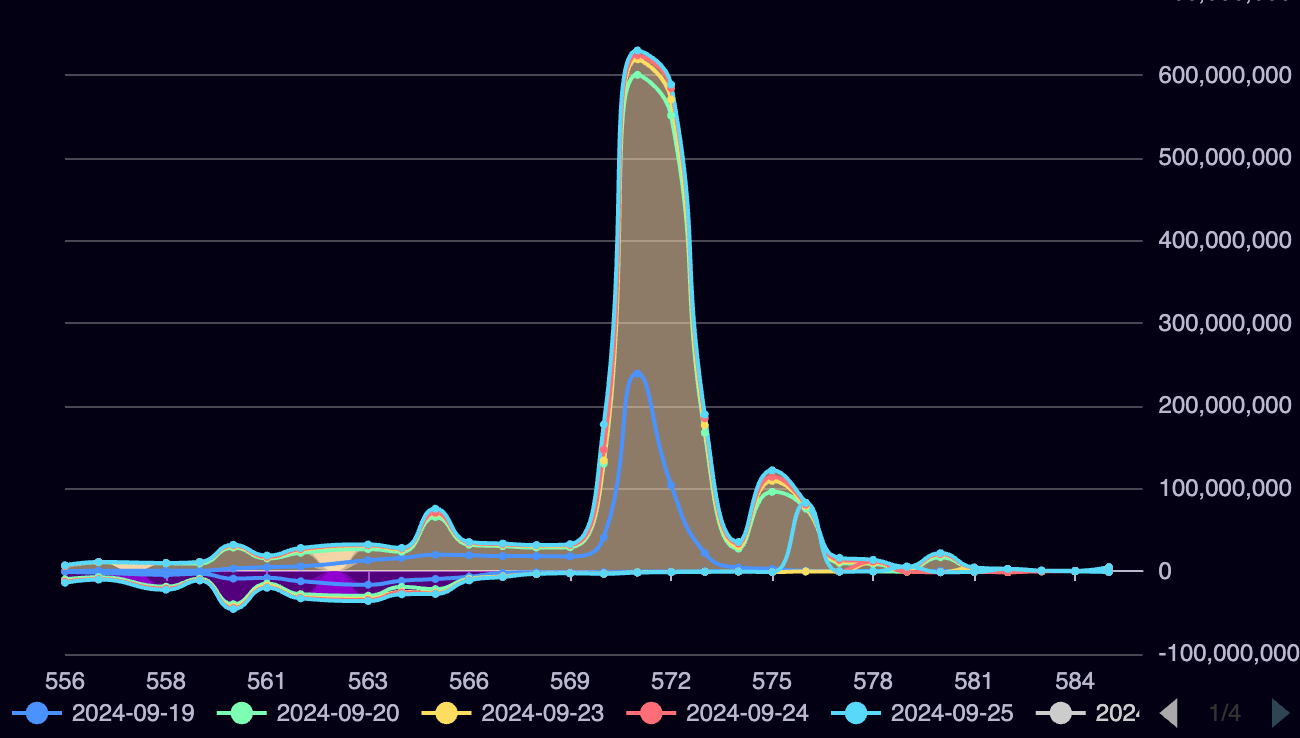

As we head into today’s large gap higher, participants can benefit from knowing some key SPY pivots for the upcoming session.

SPY pivot = 570

NO LONGS BELOW

Target 565

>570 watch the 571-572 area

This area contains the bulk of positive gamma exposure, buyers can remain in control if it can sustain trade above

Target 575

Should 571-572 act as resistance, buyers will need to utilize the 570 key pivot as support.