US joins Israel/The Week Ahead

US bombs Iran's nuclear sites, the fallout, earnings, SPY, TSLA + more

Good Morning Substack,

After President Trump approved the bombing of Iran’s nuclear sites, Operation Midnight Hammer was successfully carried out by U.S. B-2 bombers.

After the United States completed military strikes on Iran’s nuclear enrichment facilities, potentially major complications have begun to unfold.

A Heightened Risk of Attacks on U.S. Military bases positioned in the middle east.

Iran has stated that all options are on the table and vows to retaliate to U.S. bombings. U.S. troops in the region have already been briefed to prepare for a “heightened threat environment”.

Iran Parliament moves to close The Strait of Hormuz

Although The Strait of Hormuz has never been fully closed, the fear of closure has historically created a short-term spike in oil prices.

Any closure of the strait can have a crippling impact on the world’s crude oil supply as roughly 20% of all global oil consumed daily passes through the Strait of Hormuz.

Iran’s Uranium is still safe?

Initial reports seem to suggest Iran was aware of the potential looming bombing and took the opportunity to evacuate their uranium stockpile elsewhere.

The U.S. & Israel’s attacks could prompt a now angry Iran to build a nuclear bomb quicker than they previously would have.

Economic Calendar

Monday, June 23

S&P flash U.S. services/manufacturing PMI

Existing Home Sales

Tuesday, June 24

S&P Case-Shiller home price index

Consumer Confidence

Fed Chair Powell testifies to House Financial Service Committee

Wednesday, June 25

New home sales

Thursday, June 26

Advanced U.S. goods trade balance

Advanced retail and wholesale inventories

Initial Jobless Claims

Durable goods orders

GDP (second revision)

Pending Home Sales

Friday, June 27

Consumer sentiment

Personal income

Personal spending

PCE index / YoY

Core PCE / YoY

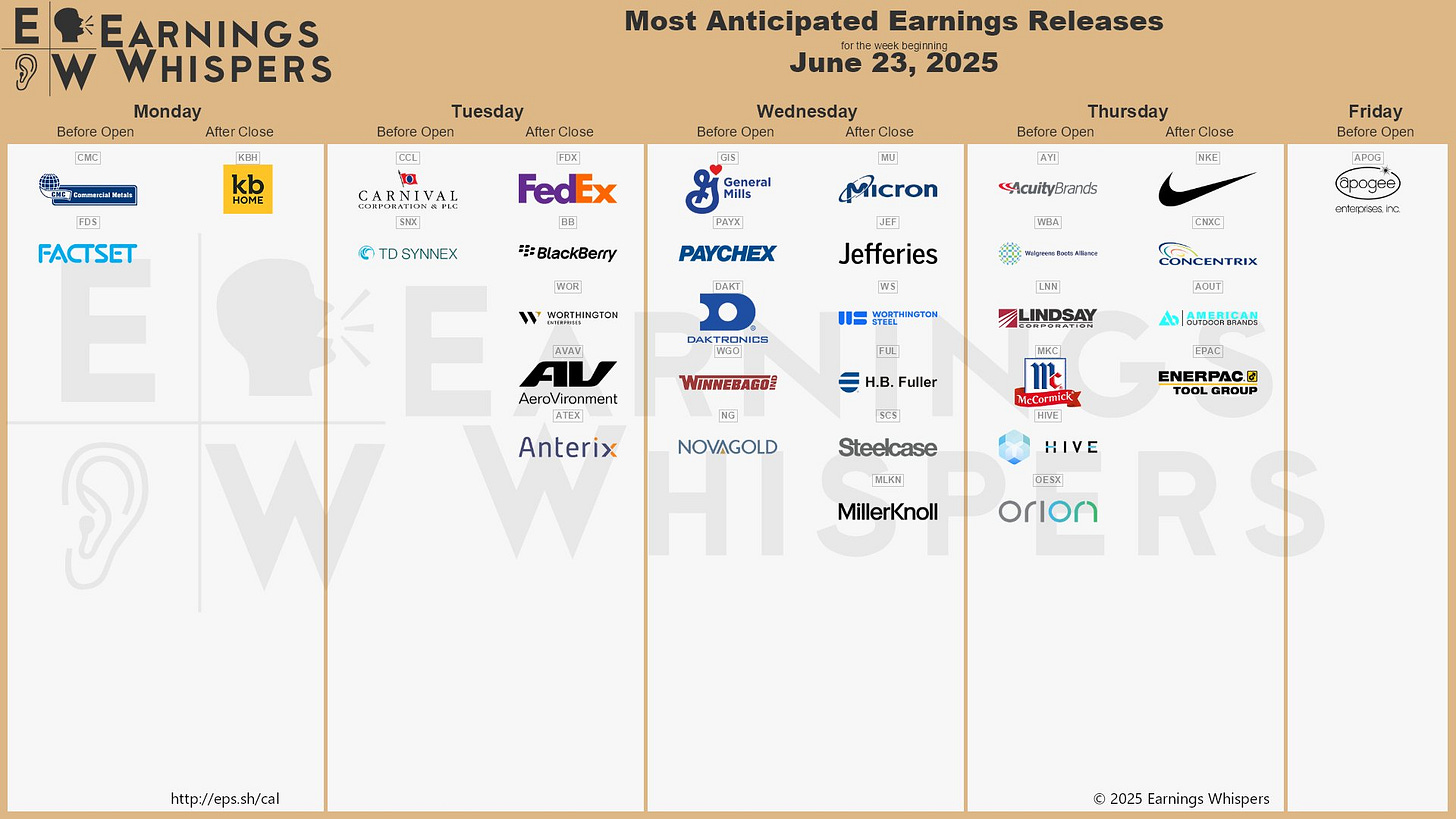

Earnings Calendar

FDX major pivot for the week ahead = 220

FDX pivot = 220

Short only below

Potential weakness below towards 200

Long above 230

Positive gamma positioning will take control above

Targets 240, 250

An important week for NKE is on the horizon

After testing the largest volume shelf on the weekly timeframe to begin Q2 trade, NKE has slowly begun to recover some of Q1’s losses

NKE earnings pivot

$60

Peak delta and gamma exposure at the spot

Long only on sustained trade above

Target 65

Failure to reclaim 60 as support can result in NKE once again trading lower

Target 55

SPY 0.00%↑ Greeks

The developments in Iran over the weekend lean bearish as we head into this week. It is challenging to be bullish currently as the market awaits Iran’s response to the U.S. attacks.

The market is likely awaiting Iran’s response, and any retaliation against American troops is likely to draw the U.S. back in for further attacks.