The Week Ahead 12/15

SPY update +3 stocks to watch

Credit Deregulation

Over the last few weeks to months, US banking agencies have made moves to ease regulations on credit markets.

The impacts of policy changes can impact financial markets, institutions, and consumers.

Eased Capital Requirements - freeing up capital, allowing an easing of previous leverage rules for large banks

Lower Compliance and Operational Costs - greater flexibility and lower operating costs for credit unions

Both of these moves have the potential to allow banks, both large and small, to compete with private equity. It can also benefit financial markets in the short term, allowing for an increase in stock buybacks.

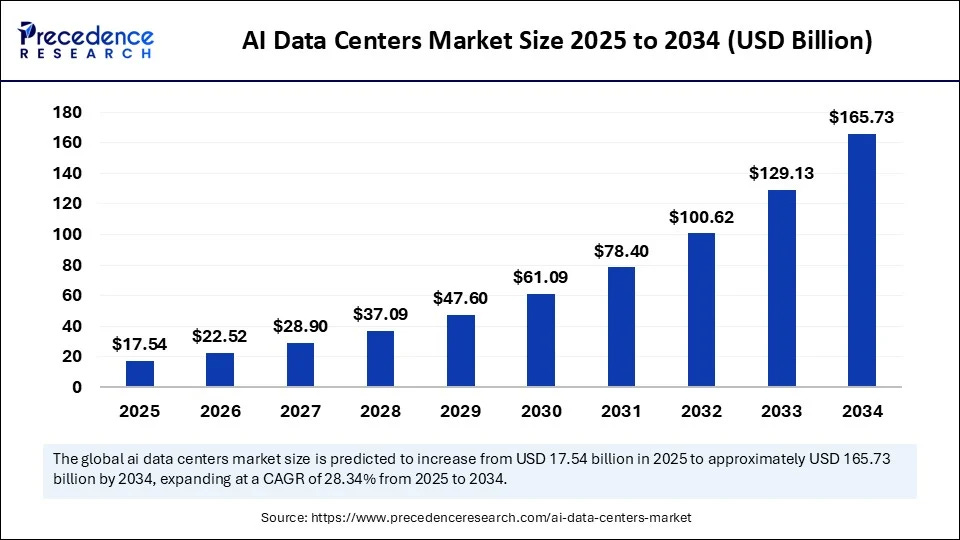

This is rather important right now in the AI space as data centers will continue to see massive funding and growth over the coming decade.

The risk to the move towards deregulation is that many of these policies were enacted following the 2008 financial crisis.

Improper risk management has the potential to topple entire sectors or even markets, depending on how concerning the underlying issue has become once unveiled publicly.

SPY 0.00%↑

After gapping higher to begin Friday’s session, the SPY sold off for the majority of the session, quickly flipping investors from bullish to bearish.

While the daily chart looks somewhat daunting, a zoom out further to the weekly view shows Friday’s range was not as big as it looked.

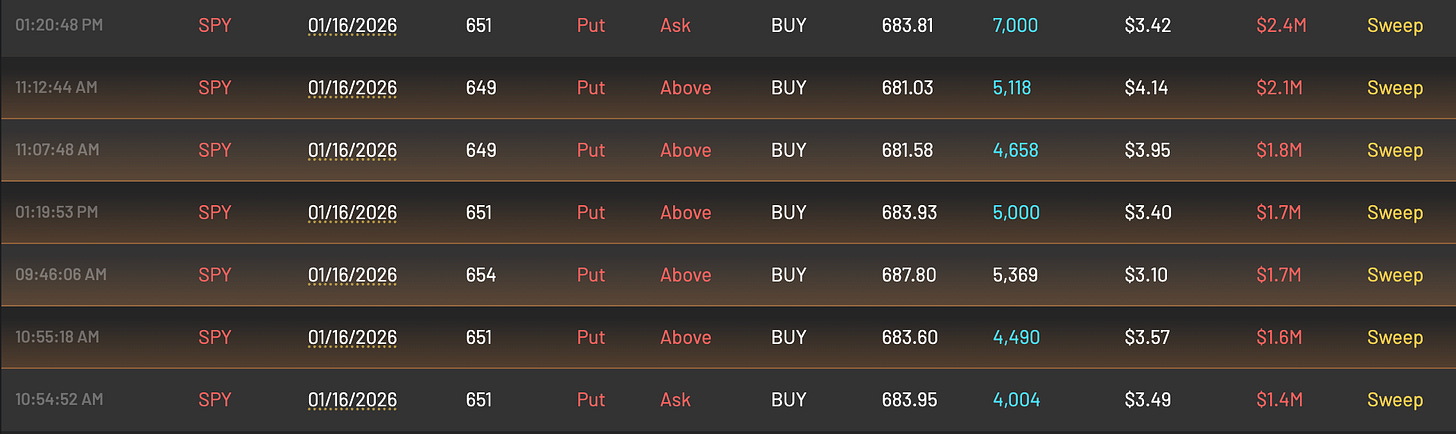

Many big players participating in Friday’s session used the opportunity to position in 1/16/26 SPY puts while the SPY was trading at the 683 level.

The above put activity is attempting to target the Q4 SPY lows as it enters 2026 trade. However, without seeing some strong sellers at/around the 683 level on the SPY this activity could be a trap. It is important for those looking for a move lower to see sellers step up to protect this area, until this happens it should remain on the back burner.

Stocks to Watch

MU 0.00%↑ Earnings

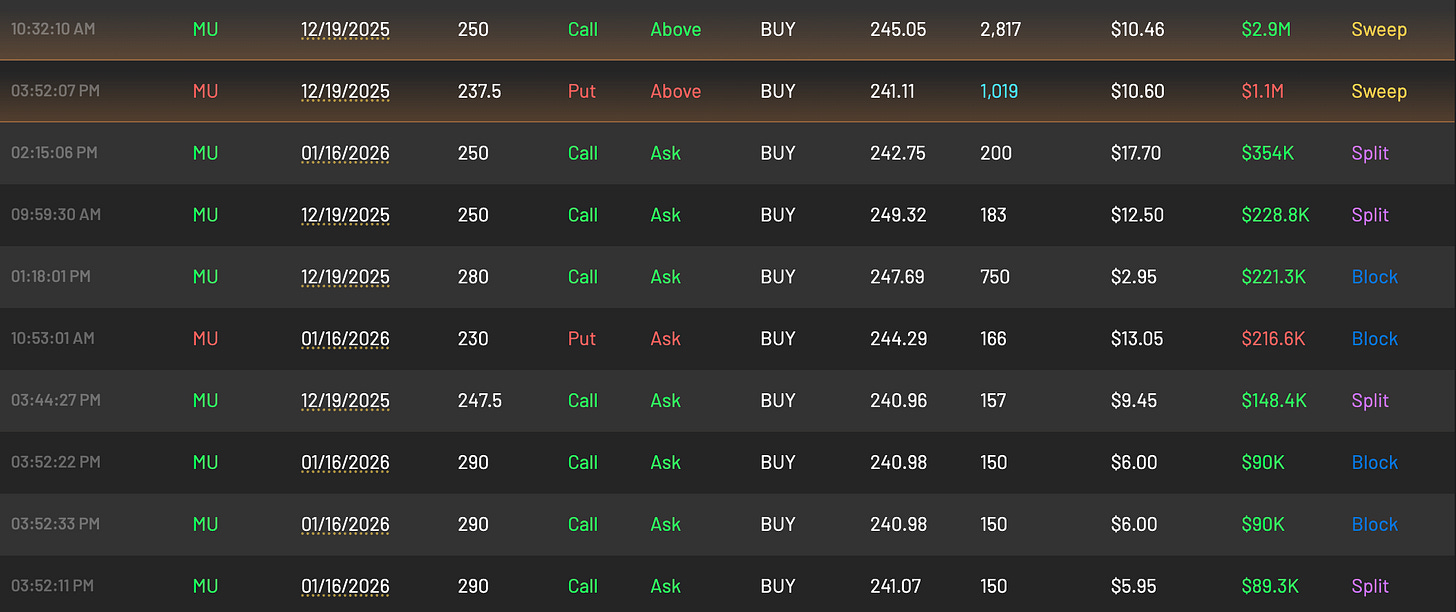

After outpacing the overall market to the downside on Friday, MU is coming to a key spot, garnering an uptick in option activity along the way.

Micron is expected to report earnings on 12/17 after the market closes and investors will be watching this name closely as it can have a large impact on the AI space.

Last quarter, MU showed that revenue from the Cloud Memory Business Unit nearly quadrupled compared to the prior year, highlighting Micron’s significant advantage in the AI/data center market.

Market makers are pricing in a rather large move for MU during the week ahead of roughly 10.4%.

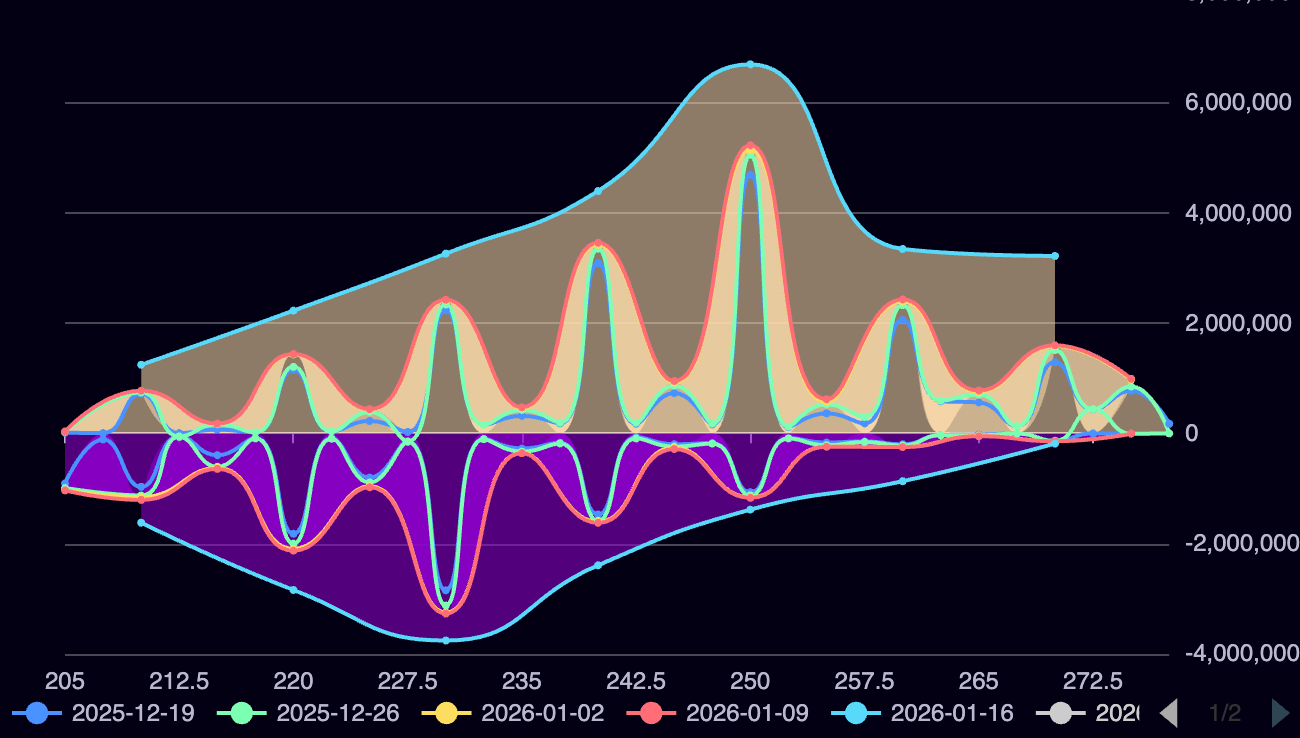

Gamma positioning shows that acceptance >250 is how bulls can take control. However, any failure to find acceptance above 250 can see sellers take control and move lower towards peak negative gamma exposure at 230.