Good Morning Substack,

As Wall Street prepares for a shortened trading week, it is important to remember the reasoning behind Monday’s stock market closure.

Thank you to all the men and women who have sacrificed their lives during service to our country to fight for our freedom. To active and past military personnel, thank you for all your sacrifices. You are all true heroes, and I am forever grateful for the service you provided our country.

Economic Calendar 5/27-5/30

Tuesday, May 27

Durable goods orders

Durable goods minus transportation

Consumer confidence

S&P CoreLogic Case-Shiller home price index

Wednesday, May 28

FOMC Fed Minutes (from May meeting)

Thursday, May 29

Initial Jobless Claims

GDP

Pending home sales

5 Fed Speakers

Friday, May 30

Personal income

Consumer Spending

PCE index / YoY

Core PCE / YoY

Advanced U.S. trade balance in goods

Advanced retail inventories

Advanced wholesale inventories

Chicago Business Barometer (PMI)

Consumer sentiment

Earnings Calendar

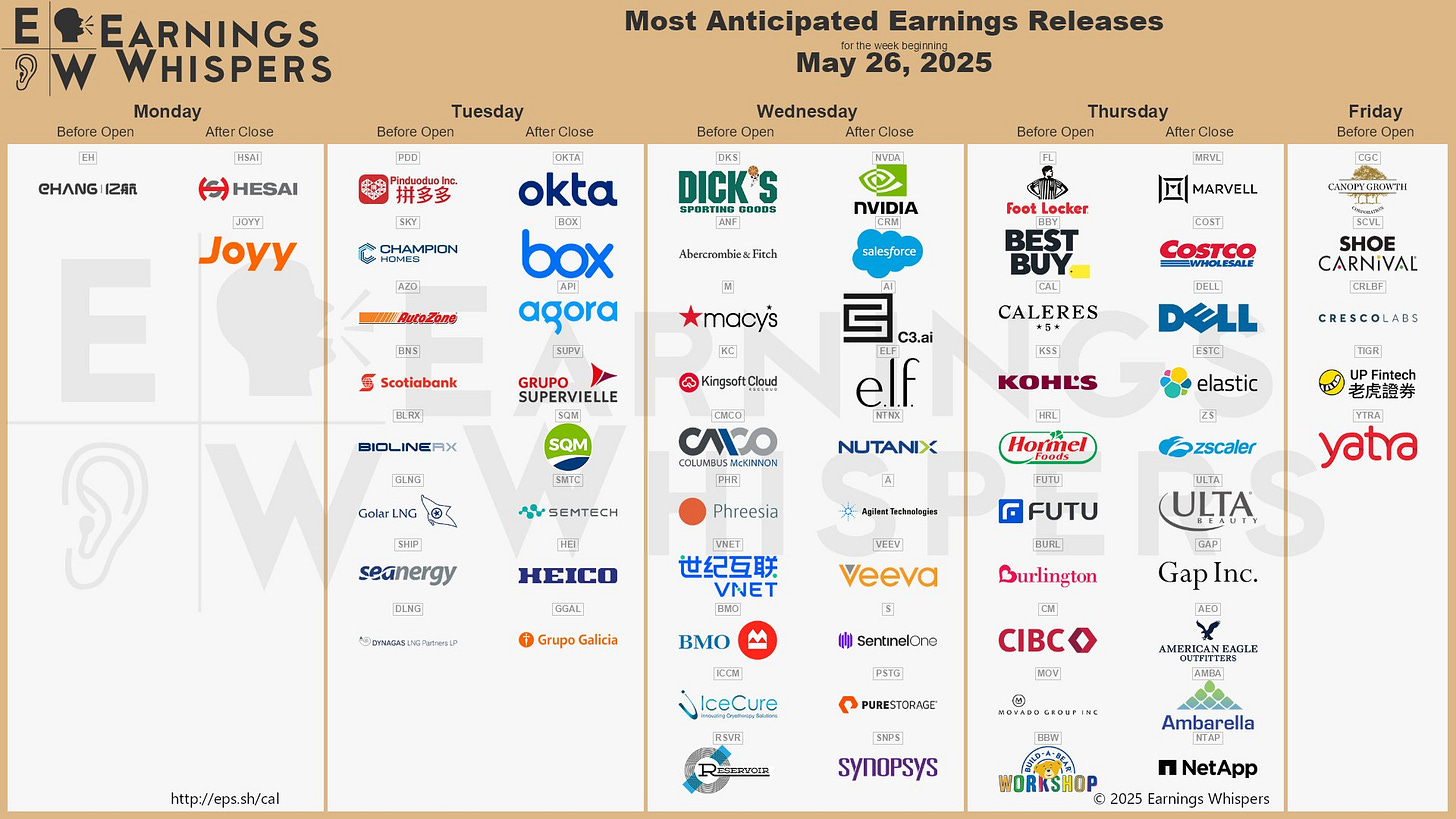

This week’s most anticipated earnings are provided via eWhispers on X. Headlining this week is NVDA, who’s set to report earnings Wednesday after the market closes.

Tuesday, May 27

BOX

PDD

AZD

Wednesday, May 28

DKS

M

NVDA

CRM

AI

ELF

Thursday, May 29

FL

BBY

KSS

FUTU

MRVL

COST

AEO

Futures

Although the stock market is closed today for Memorial day, it hasn’t stopped global investors from buying futures. All three major indices are currently over 1% higher from Friday’s close.

Consumer Cyclical / Specialty Retail

This week’s scheduled earnings features both ULTA and ELF beauty and will leave investors with additional insight within the specialty retail sector.

One divergence between two large players within the space has presented itself over the last few quarters. Although ELF continued to show steady sales and revenue growth (and has done so for 22 consecutive quarters) they stock has diverged from the performance seen in competitors such as ULTA.

While ULTA is only down just over 6% YTD, ELF sits over 33% lower than where it opened 2025’s trade.

Options activity has remained rather muted for both of these names throughout May’s trading.

ELF 0.00%↑ Earnings Pivots

ELF pivots

Long >75, 80

Targets 85, 90

Sustained trade >90 can target the positive gamma exposure sitting between 95 and 100

No longs <75

Target 70

Any loss of 70 is bearish and can continue to see increased selling pressure

Targets 65, 60 (60, should it trade, is a likely support)

ULTA 0.00%↑ Earnings Pivots

ULTA earnings pivots

PIVOT 400

Bullish above

Targets: positive gamma exposure between 420-425 strikes

Sustained trade >425 targets 440, 450

PIVOT 395

Bearish below

Target: negative gamma exposure at 360

NVDA 0.00%↑ Earnings Pivots

All eyes will once again be on NVDA during the week ahead as it is set to report earnings on Wednesday after the market closes. To decipher NVDA’s price action during the week ahead, traders can utilize the pivots derived from market makers’ net greek positioning to derive important inflection points and potential targets above and below.