Good Morning Substack,

Despite dipping lower during both Tuesday and Friday trade, market participants used the opportunities to buy the dip as the SPY closed the week in the green.

Economic Calendar

Monday, June 2

Construction spending

U.S. Manufacturing PMI

ISM manufacturing index

Fed Chair Jerome Powell speech (7pm est)

Tuesday, June 3

Factory Orders

Wednesday, June 4

Fed Beige Book

Thursday, June 5

Initial Jobless Claims

International Trade Report

Friday, June 6

May U.S. jobs report

In addition to this week’s Beige Book, traders that are looking to analyze the importance of this week’s economic events can utilize the Fed’s comments surrounding both inflation and the labor market.

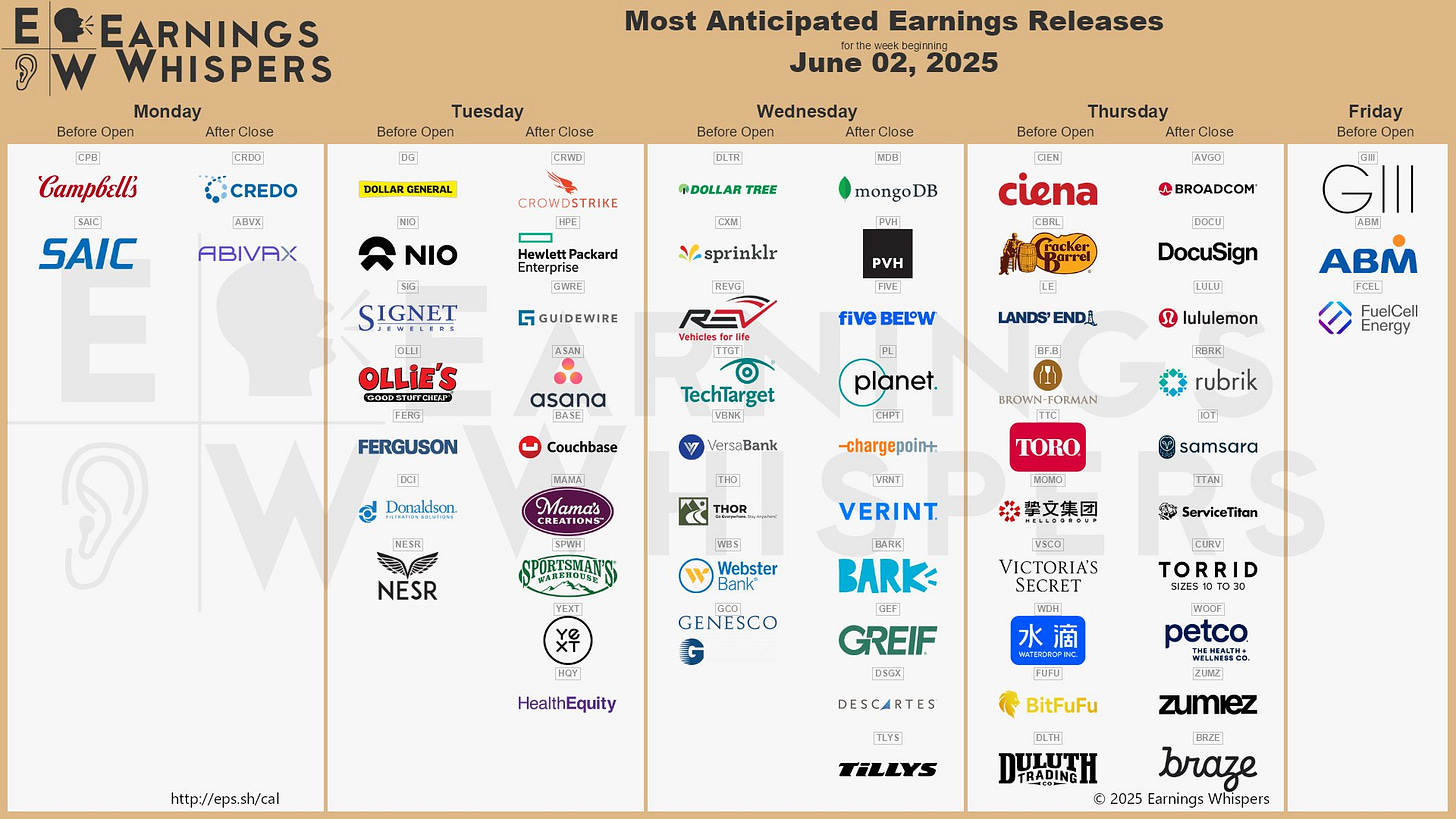

Earnings Calendar

Tuesday, June 3

NIO

Earnings pivot = 4

Short below/long above

DG

Earnings pivot = 100

Long above

Target 110

Short below

Targets 95, 90

Positioning also suggests dips to 90 should they present themselves, will be supported

CRWD

HPE

Wednesday, June 4

DLTR

FIVE

BARK

Thursday, June 5

AVGO

DOCU

LULU

Stocks to Watch

CSX 0.00%↑

CSX stock showed continued strength after a gap higher to begin last week’s trade. The stock looks primed for a potential continuation as we are set to enter June trade.

During Friday’s session, CSX saw an uptick in options activity. The activity from the session can be classified as both directional and bullish.

CSX does not typically get mass amounts of option activity, so the gamma positioning for the week ahead looks odd. However, the important data traders should take from it is that market makers will remain long CSX >30 & 32.5 during the coming week of trade.